Loading...

--

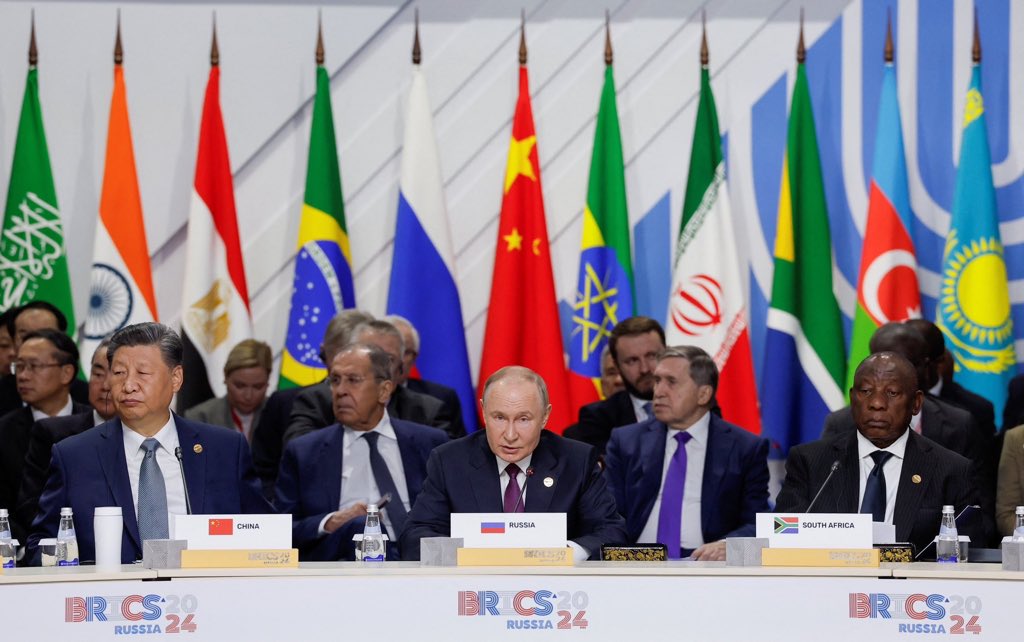

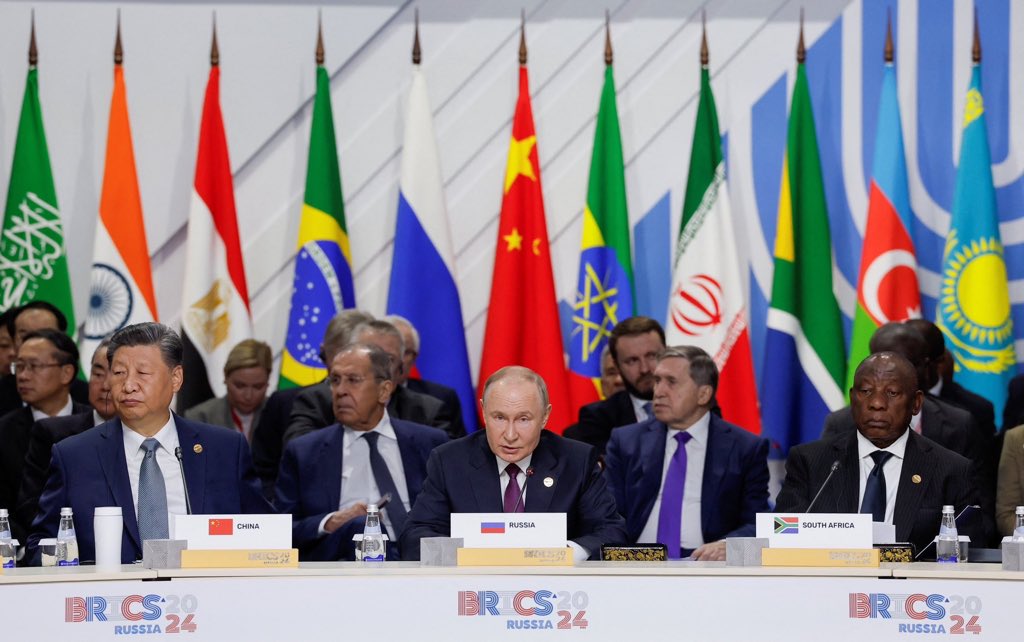

[Trump: BRICS is an attack on the dollar] Former U.S. President Trump stated that the actions of the BRICS organization are an attack on the dollar, suggesting that it could pose a threat to the dollar's global status. (Watcher.Guru)

[Trump: BRICS is an attack on the dollar] Former U.S. President Trump stated that the actions of the BRICS organization are an attack on the dollar, suggesting that it could pose a threat to the dollar's global status. (Watcher.Guru)

[Bitwise: Corporate Bitcoin Holdings Surpass 1.02 Million BTC in Q3 2025, Up Nearly 21% Quarter-on-Quarter] The Q3 2025 Corporate Bitcoin Adoption Report released by Bitwise shows that the total corporate Bitcoin holdings reached 1.02 million BTC, a quarter-on-quarter increase of 20.87%, accounting for 4.87% of Bitcoin's total supply. The total value of Bitcoin held amounts to $117 billion, reflecting a quarter-on-quarter growth of 28.33%, with the average Bitcoin price during the quarter at $114,402. Additionally, new Bitcoin holdings in the third quarter reached 176,762 BTC, indicating a continued rise in corporate demand for Bitcoin.

The latest 4-hour cycle K-line shows that the price has fallen below the key resistance level near $113500. The member exclusive chip distribution indicator shows that there is a clear chip concentration area above $115097, with heavy selling pressure. Combined with the recent black three soldier pattern and the MACD double top signal, the market sentiment tends to be bearish. The current EMA24 and EMA52 are in a bearish alignment, and the RSI has failed to break through the upward trend line, further verifying downward pressure. The trading volume has shrunk to a recent low, indicating that the bulls are unable to counterattack. Pay attention to the 111640 USD chip intensive area below. Member indicators accurately capture resistance levels, assisting in bottom fishing and top flight. Open membership immediately and seize the turning point of the market! The data is sourced from the PRO member's [BTC/USDT Binance USDT perpetual 4-hour] K-line, for reference only, and does not constitute any investment advice.

[Gold Hits Record High, Bitcoin Shows Strong Correlation] Gold prices continue to reach historic highs, while Bitcoin demonstrates a strong correlation with gold, reflecting investors' focus on inflation-hedging assets. (Cointelegraph)

[Figure Introduces SEC-Registered Token YLDS to Sui Blockchain] Figure Technology Solutions announced that its SEC-registered yield-bearing security token YLDS will be launched on the Sui blockchain, marking the token's first expansion beyond the Provenance Layer 1 network. YLDS is backed by short-term U.S. Treasury bonds and repurchase agreements, aiming to eliminate traditional intermediaries and provide users with equal access to institutional-grade financial products.

[CME Data Shows 97.3% Probability of Fed Rate Cut in October] According to data from the CME 'FedWatch' tool, there is a 97.3% probability that the Federal Reserve will cut rates by 25 basis points at its October meeting, while the probability of maintaining rates remains at just 2.7%. Looking ahead to the December meeting, the probability of keeping rates unchanged drops to 0.1%, the cumulative probability of a 25-basis-point rate cut is 6.4%, and the cumulative probability of a 50-basis-point rate cut rises significantly to 93.5%.