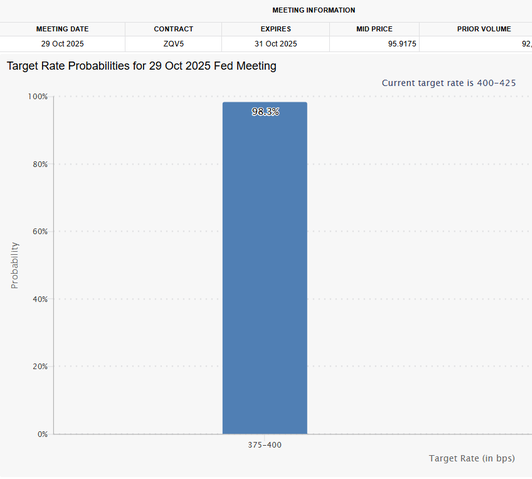

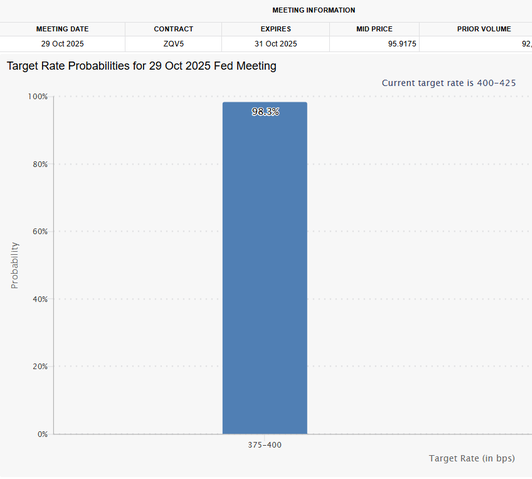

[Federal Reserve: Market Expects Rate Cut to 3.75%-4.00% in October] Market data shows a 98.3% probability that the Federal Reserve will cut interest rates to 3.75%-4.00% at the October 29 meeting. (Cointelegraph)

[Federal Reserve: Market Expects Rate Cut to 3.75%-4.00% in October] Market data shows a 98.3% probability that the Federal Reserve will cut interest rates to 3.75%-4.00% at the October 29 meeting. (Cointelegraph)

From the perspective of membership indicators, the current trading volume has significantly shrunk to 34.29% of the recent average, and market activity has significantly decreased. At the same time, KDJ has entered the overbought area and a dead cross has appeared, releasing a short-term correction signal. Based on the distribution of chips, the price is approaching the resistance zone of 4496.5, and the high volume node (HVN) corresponding to this position indicates the possibility of strong selling pressure. Recently, the K-line has formed a top shaped pattern, further verifying the downside risk. Although EMA24 and EMA52 maintain an upward trend, the MACD bar chart shows a double peak, indicating a weakening of upward momentum. If the price falls below the 4250 support level or tests the key support level of 4144.5 below. Activate membership immediately and accurately grasp key points and chip dynamics! The data is sourced from the PRO member's [ETH/USDT Binance USDT Perpetual 1-hour] K-line, for reference only, and does not constitute any investment advice.

[U.S. Government Shutdown Enters Day 13, Partisan Deadlock Continues] The U.S. government shutdown has entered its 13th day, with House Minority Leader Jeffries accusing Trump of blocking negotiations between Republicans and Democrats. House Speaker Johnson warned that if Democrats reject the temporary funding bill, this shutdown could surpass the 35-day record set in 2018-2019. Both sides have yet to reach an agreement on the funding issue.

[Ethereum Stablecoin Active Addresses Surpass One Million for the First Time] According to Golden Finance, in 2025, the average weekly unique sending addresses for Ethereum stablecoins reached 720,000, and for the first time in the past two weeks, surpassed 1 million. Over the past year, this data has shown exponential growth, primarily driven by increased stablecoin adoption and related applications, including perpetual contracts, prediction markets, and settlement demands for tokenized physical asset projects. Ethereum, as a primary settlement layer, continues to attract more capital flows, with active addresses steadily increasing.

[Microsoft Accused of Raising ChatGPT Prices Through Agreement with OpenAI] Microsoft has been accused of violating antitrust laws by allegedly raising ChatGPT prices through its exclusive agreement with OpenAI. A class-action lawsuit has been filed in federal court in San Francisco, claiming that Microsoft restricted the supply of computing resources, harming market competition and user experience. It is reported that Microsoft has invested over $13 billion in OpenAI.

TD Cowen analysts stated that progress on crypto market structure legislation in the U.S. Senate might have to wait until after the midterm elections. There are clear differences between Republicans and Democrats regarding regulatory approaches, leading to slow negotiations. Republicans advocate for clarifying crypto asset jurisdiction and defining non-security cryptocurrencies, while Democrats focus on preventing illegal activities in decentralized finance, though facing criticism. Procedural differences in legislation are not significant enough to block an agreement, but senators lack strong motivation to push forward. It is expected that the legislation will be delayed.