In the live broadcast of Fuxi Community: Do you aim for the top or the bottom? What is the intention behind the adjustment and decline?

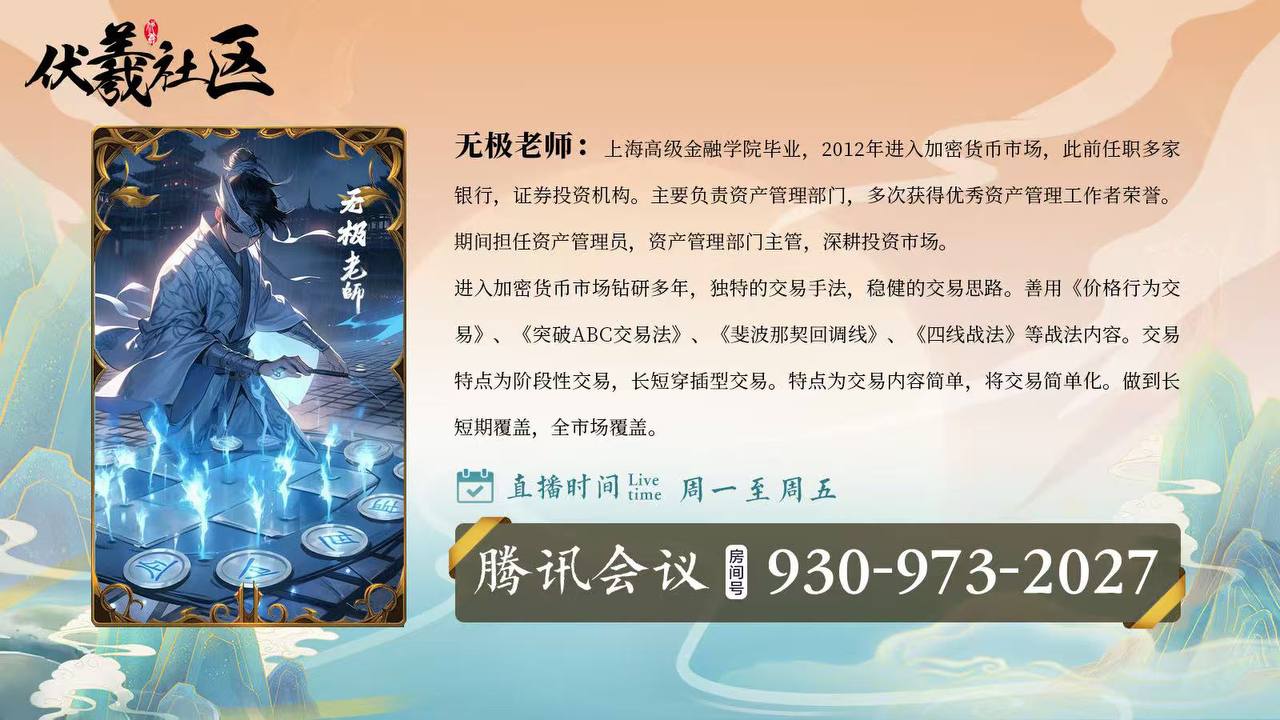

Click on the link to enter Tencent Meeting: https://meeting.tencent.com/p/9309732027 BTC: After reaching a high of 123300 in the market, the market entered a period of oscillation that lasted for half a month. During the oscillation, a top structure gradually formed, and a three top structure showed signs of topping. According to the current daily level structure confirmation relationship, the low point of the large market can be observed at 109800. After the large market fell at the top structure, the daily level pullback structure was not safe. The resonance between the hourly level and daily level structures gave rise to the M top trend. Currently, the large market focuses on the support position at 112800 during the day, and if it falls below 112800, the market is likely to reach 109800-108000. The upper pressure level is 116000. ETH: The recent trend of Ethereum has been volatile, with signs of peaking at the daily level, and the pullback performance after the 4-hour level drop does not reflect the possibility of breaking new highs in the future. The key focus of Ethereum is to pay attention to the 4-hour short-term pressure level between 3755-3735. Within this range, a bearish signal is given to confirm the possibility of a significant downward adjustment in the subsequent market trend. The high point trend after the hourly level correction conforms to the V-shaped channel pattern, with the right high point at 3737 and the bottom important support position at 3568. Tencent Meeting Number: 930 973 2027 QQ group: 123116768 Join the Fuxi Community and enjoy a variety of service offerings 1. Conduct market analysis for daily open courses and develop plans for matching orders and solving problems. 2. Join the member group to enjoy live streaming with orders in the evening; Fixed weekly technical course content. 3. Multiple market analysis and strategic trading within the day. 4. "Price Behavior Trading", "Breakthrough ABC Trading Law", "Four Line Battle Method" 5. Use tactics such as "Gann's Angle of Power", "Fei's Wave Number Example", and "MACD" to deduce the future direction. Disclaimer: The above content only represents the author's personal opinion and is for communication and sharing purposes only. It does not represent the position or viewpoint of AiCoin and does not constitute any investment advice. Based on this investment, there may be external contacts, which have nothing to do with AiCoin, and the consequences shall be borne by oneself.